In the digital age, where peer-to-peer payment apps like Venmo have become a staple in our daily transactions, it’s vital to stay vigilant against scams.

A prevalent one that’s been causing concern is the Venmo ‘Suspicious Activity’ text scam. If you’ve received such a message and are wondering about its authenticity, this article is here to guide you.

What is Venmo Suspicious Activity Text scam?

The Venmo Suspicious Activity Text scam is a type of phishing attack specifically targeting users of the Venmo mobile payment service. This scam involves sending deceptive text messages to trick users into divulging their sensitive personal and financial information.

How Does It Work?

Fake Alert via Text Message:

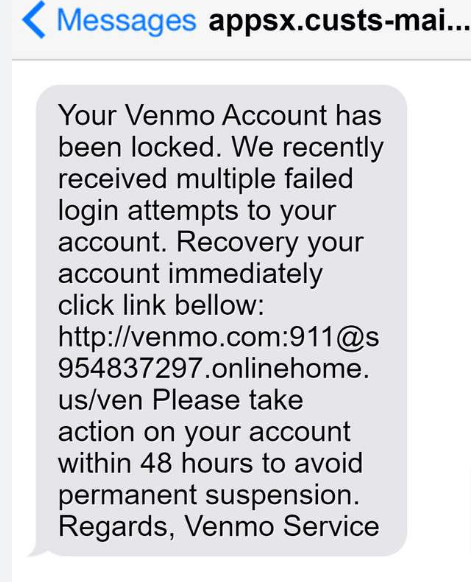

- You receive a text message, seemingly from Venmo, claiming there’s suspicious activity on your account.

Urgent Call to Action:

- The message urges you to click on a link to secure your account.

Deceptive Link to a Fake Website:

- The link in the message takes you to a website that looks like Venmo’s login page, but isn’t.

- This fake site is designed to steal your information.

Request for Personal Information:

- The website asks you to enter your Venmo login details and sometimes other personal data.

Risk of Information Theft:

- If you enter your details, scammers can steal your information.

- This can lead to unauthorized access to your Venmo account and potential financial loss.

How to avoid Venmo Suspicious Activity Text scam

1. Identify Fake Websites

- Understanding URL Structures:

Scammers often use cleverly disguised URLs. For example, a legitimate URL like support.venmo.com might be mimicked as venmo.support.com.

The latter, while appearing genuine, is actually a domain (support.com) with a subdomain (venmo), which is not affiliated with Venmo.

- Domain Name Red Flags

Be wary of URLs that have additional segments or unusual formats, particularly those that end in lesser-known top-level domains.

2. Ignore Instructions Through Texts

- Venmo’s Communication Protocol:

Venmo usually communicates important account information through the app itself, not via SMS.

Any critical alert about your account will likely appear as an in-app notification.

- SMS as a Scamming Tool

Text messages are a common medium for scammers since they can be sent en masse and crafted to mimic official communication.

3. Never Share Account Details

- The Importance of Privacy

Your Venmo login information is as sensitive as your bank PIN. Sharing it, even with trusted individuals, can lead to unauthorized access to your account.

- Social Engineering Threats

Scammers may use various tactics to coax your details from you, including posing as Venmo support.

4. Beware of Money Earning Schemes

- Typical Scam Offers

Offers that promise high returns in a short period are red flags.

Scammers often use the lure of easy money to trick victims into revealing their account details or making an upfront payment.

- Understanding the Risks

Engaging with these schemes can lead not only to financial loss, but also to compromised personal information.

5. Contact Venmo and Your Bank in Case of Scams

- Immediate Action

If you suspect that you’ve fallen for a scam, contact Venmo’s customer support immediately. The sooner you report, the better the chances of mitigating the damage.

- Involving Your Bank

Notify your bank, especially if any unauthorized transactions have been made. They may have protocols to help in fraud cases.